Special election: Edwardsburg and St. Joseph schools tax renewals

There were several cities that had proposals on the ballot during Tuesday's special election, including two school operating tax renewals. The St. Joseph Public Schools tax renewal was approved by 80% of voters.

St. Joseph Public Schools - APPROVED [full election results]

The St. Joseph Public Schools operating tax renewal would renew the millage that expires in 2019. The tax, $19.6292 on every $1000 of assessed value, would not apply to principal residences and other property restricted by law.

The tax would be renewed for a period of 5 years to pay for operating expenses.

Full text of the ballot proposal

ST. JOSEPH PUBLIC SCHOOLS OPERATING MILLAGE RENEWAL PROPOSAL

This proposal will allow the school district to continue to levy the statutory rate of not to exceed 18 mills on all property, except principal residence and other property exempted by law, required for the school district to receive its revenue per pupil foundation allowance and renews millage that will expire with the 2019 tax levy.

Shall the currently authorized millage rate limitation of 19.6292 mills ($19.6292 on each $1,000 of taxable valuation) on the amount of taxes which may be assessed against all property, except principal residence and other property exempted by law, in St. Joseph Public Schools, Berrien County, Michigan, be renewed for a period of 5 years, 2020 to 2024, inclusive, to provide funds for operating purposes; the estimate of the revenue the school district will collect if the millage is approved and 18 mills are levied in 2020 is approximately $5,853,374 (this is a renewal of millage that will expire with the 2019 tax levy)?

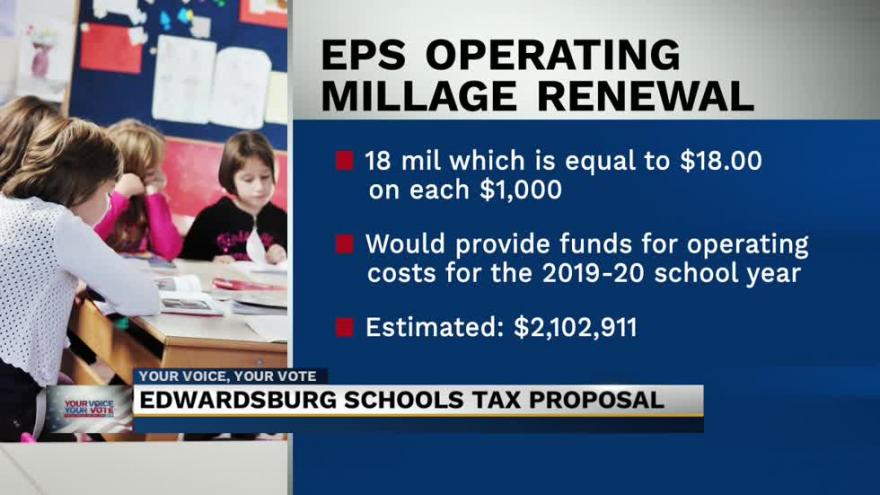

Edwardsburg Public Schools

Edwardsburg Public Schools are also requesting a renewal of a tax levy. The district is requesting $18 per every $1,000 of taxable valuation. It would not apply to principal residences.

The money would cover operating expenses.

Full text of the proposal

EDWARDSBURG PUBLIC SCHOOLS OPERATING MILLAGE RENEWAL PROPOSAL

This proposal will allow the school district to continue to levy the statutory rate of not to exceed 18 mills on all property, except principal residence and other property exempted by law, required for the school district to receive its revenue per pupil foundation allowance.

Shall the limitation on the amount of taxes which may be assessed against all property, except principal residence and other property exempted by law, in Edwardsburg Public Schools, Cass County, Michigan, be increased by 18 mills ($18.00 on each $1,000 of taxable valuation) for the year 2019 to provide funds for operating purposes; the estimate of the revenue the school district will collect if the millage is approved and levied in 2019 is approximately $2,102,911 (this is a renewal of millage that expired with the 2018 tax levy)?