Primary election: Elkhart and Plymouth school tax referenda

See Also

The Elkhart Community Schools operating tax failed with 63% of voters against the measure.

The Plymouth Community Schools property tax also failed with 64% of voters against the measure.

Elkhart Community Schools

Voters in the Elkhart Community Schools district will vote on a referendum that would eliminate the previous referendum tax levy and replace it with one that would impose a tax of 58-cents for every $100 of assessed valuation of property. The money would go towards academic and educationally related programs, managing class sizes, school safety initiatives, and attracting and retaining teachers.

Full text of the ballot question:

For the eight (8) calendar years immediately following the holding of the referendum, shall Elkhart Community Schools impose a property tax rate that does not exceed fifty-eight cents ($0.58) on each one hundred dollars ($100) of assessed valuation and that is in addition to all other property taxes imposed by the school corporation for the purpose of (a) repealing the existing referendum fund tax levy, and (b) replacing the existing referendum fund tax levy with a new referendum fund tax levy that will provide funding for academic and educationally related programs, managing class sizes, school safety initiatives, and attracting and retaining teachers?

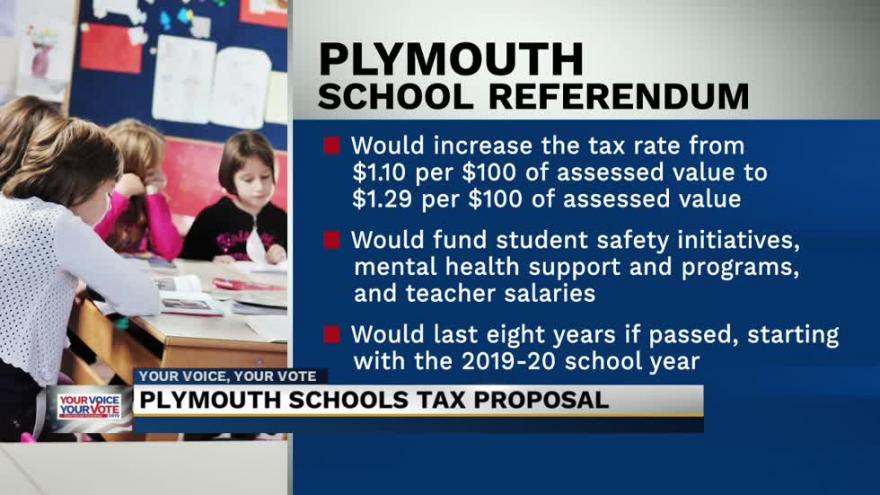

Plymouth Community Schools

The Plymouth Community Schools referendum would impose a tax of 19-cents for every $100 of assessed valuation. The money would fund student safety initiatives, mental health support and programs, and attracting and retaining teachers?

Full text of the ballot question:

For the eight (8) calendar years immediately following the holding of the referendum, shall the Plymouth Community School Corporation impose a property tax rate that does not exceed nineteen cents ($0.19) on each one hundred dollars ($100) of assessed valuation and that is in addition to all other property taxes imposed by the school corporation for the purpose of funding student safety initiatives, mental health support and programs, and attracting and retaining teachers?